Search

Latest topics

» PETER OF ENGLAND IS BACK.by daveiron Mon Nov 25, 2024 2:48 am

» HSBC advice please.

by assassin Sun Nov 24, 2024 2:00 pm

» Salary Finance

by daveiron Thu Nov 21, 2024 7:44 pm

» apricot kernels

by memegirl777 Tue Nov 19, 2024 3:10 pm

» Leighton vs Bristow & Sutor high court ruling. 'enforcement agent' needed to supply a legally executed liability order to prove any authority.

by wakey wakey Sun Nov 10, 2024 4:01 pm

» Brandon Joe Williams

by grams Sat Nov 09, 2024 11:29 am

» A Parcel sent to me worth 99p ! Court Claim received !

by memegirl777 Sun Nov 03, 2024 4:53 pm

» UK Courts Using Faulty Cell Site Data a Serious Concern!!

by midnight Sun Nov 03, 2024 1:32 pm

» Clowells continue

by Biggiebest Sat Nov 02, 2024 11:47 am

» Legal responsibility

by Biggiebest Fri Nov 01, 2024 12:36 pm

» Composting Leaves

by assassin Thu Oct 31, 2024 4:25 am

» Composting

by assassin Thu Oct 31, 2024 4:22 am

» BEWARE OF TSB BANK

by daveiron Sun Oct 27, 2024 4:04 am

» Council Tax

by Lopsum Thu Oct 24, 2024 2:57 pm

» DWP

by daveiron Thu Oct 24, 2024 10:49 am

» Real Electric Cars

by assassin Sun Oct 20, 2024 3:53 am

» BOMBSHELL: Slovakia could BAN mRNA vaccines

by assassin Sun Oct 20, 2024 2:40 am

» Council Tax (getting answers)

by assassin Tue Oct 15, 2024 5:22 pm

» DSAR DELAYS

by daveiron Sun Oct 06, 2024 11:20 pm

» For those considering ,conditional acceptance

by daveiron Fri Oct 04, 2024 9:55 am

» Just got a letter

by daveiron Thu Oct 03, 2024 11:46 pm

» Ceder so called bailiffs

by Ian4644 Mon Sep 30, 2024 2:43 pm

» Our Little Food Growing Experiment

by assassin Fri Sep 27, 2024 5:01 am

» Jocabs Threatening my parents address over council tax.

by darkfireblade Mon Sep 23, 2024 9:42 pm

» Heat Your Home

by assassin Mon Sep 23, 2024 3:48 am

» Purchased Used car, thew con rod after 4 weeks, 40,000mi on clock, can we get out of the finance?

by scrwm Thu Sep 19, 2024 5:56 pm

» ULEZ London huge fine for misunderstanding

by urchinatheart Sat Sep 07, 2024 9:56 pm

» The new ruling, lie-ability order

by assassin Sat Sep 07, 2024 4:19 am

» Prepping 1 Lighting Overview

by assassin Fri Sep 06, 2024 4:34 am

» Prepping 2 Selecting Light Sources

by assassin Fri Sep 06, 2024 4:26 am

» Prepping 3 Security

by assassin Fri Sep 06, 2024 4:21 am

» Prepping 4 Planning Your Lighting

by assassin Fri Sep 06, 2024 4:18 am

» Prepping 5 Charging Your Batteries

by assassin Fri Sep 06, 2024 4:15 am

» An idea to reform the police ?

by assassin Fri Sep 06, 2024 4:02 am

» Post 2007 CCA

by Biggiebest Thu Sep 05, 2024 1:47 pm

» Travel advice please: London to Amsterdam no injects no tests

by Kaddabriol Wed Sep 04, 2024 10:39 am

» CCJ letter

by waylander62 Mon Sep 02, 2024 9:12 pm

» Disability

by assassin Sun Sep 01, 2024 3:03 am

» It works (Richard Vobes)

by assassin Sun Sep 01, 2024 2:57 am

» Veronica Chapmans approach to CT

by daveiron Thu Aug 29, 2024 11:17 pm

» Tsb many times refused basic account

by flyingfish Thu Aug 29, 2024 11:53 am

» Lowell New Address

by waylander62 Tue Aug 27, 2024 7:41 pm

» The Daily Mail doesn't know the law on facemasks and disability -ThatguyScottWeb

by Emma78 Mon Aug 26, 2024 9:29 am

» DSAR from OC

by waylander62 Mon Aug 19, 2024 8:46 pm

» Council Tax Notice of Enforcement

by Lopsum Sun Aug 11, 2024 5:26 pm

» If The State is Pushing You to Riot , Do the Reverse

by Lopsum Sun Aug 11, 2024 5:16 pm

» Grid Down Mistakes To Avoid

by assassin Tue Aug 06, 2024 5:05 am

» Grid Down Realities

by assassin Tue Aug 06, 2024 4:57 am

» Lowest of Lowest continue with their fraud

by assassin Mon Aug 05, 2024 3:09 am

» Government Prepping Food and Water

by assassin Mon Aug 05, 2024 3:07 am

» Subject access dca refused

by daveiron Sat Jul 27, 2024 12:14 am

» Pre action protocol

by Biggiebest Fri Jul 26, 2024 3:40 am

» DCA working on behalf of an energy company

by daveiron Mon Jul 22, 2024 11:45 pm

» More of the Same

by daveiron Sun Jul 21, 2024 12:19 am

» Off Grid Engine Projects

by assassin Sat Jul 20, 2024 5:03 am

Moon phases

Council Tax

+5

Msyms

urchinatheart

flyingfish

daveiron

LionsShare

9 posters

Page 1 of 2

Page 1 of 2 • 1, 2

Council Tax

Council Tax

Raconteurs last Tuesday. FFD 1:31:00 - 1:40:00 in, 1 presenter presents evidence from research over c'tax.

https://www.youtube.com/watch?v=N3l67qcr3no

The jist is simple, when going in to court to challenge c'tax you will use this point, that & the other that proves you know somat about THIER 'LAW'. It gets thrown back & 1 very simple point is raised & that's why we are all charged c'tax.

T.H.E.Y. state 'well your property could be or is capable of being a business in the furture'.

The case is retired & finished. For those that really know about c'tax statute(s) - far more than I, is it possible we the people can probably never win doing it THEIR way? We will always be shafted over c'tax in a bent corrupt system?

Comments please.

LS

https://www.youtube.com/watch?v=N3l67qcr3no

The jist is simple, when going in to court to challenge c'tax you will use this point, that & the other that proves you know somat about THIER 'LAW'. It gets thrown back & 1 very simple point is raised & that's why we are all charged c'tax.

T.H.E.Y. state 'well your property could be or is capable of being a business in the furture'.

The case is retired & finished. For those that really know about c'tax statute(s) - far more than I, is it possible we the people can probably never win doing it THEIR way? We will always be shafted over c'tax in a bent corrupt system?

Comments please.

LS

LionsShare- Moderator

- Posts : 3288

Join date : 2017-04-26

Location : Literally Where Ever I Am

assassin likes this post

Re: Council Tax

Re: Council Tax

How about a Stat Dec that this property in not used in commerce.

But of course as you say its corrupt to the core.

But of course as you say its corrupt to the core.

daveiron- Admin

- Posts : 4987

Join date : 2017-01-17

assassin and LionsShare like this post

Re: Council Tax

Re: Council Tax

Excellent point DI but someone with more knowledge than I would have to elaborate more.daveiron wrote:How about a Stat Dec that this property in not used in commerce.

But of course as you say its corrupt to the core.

LionsShare- Moderator

- Posts : 3288

Join date : 2017-04-26

Location : Literally Where Ever I Am

assassin likes this post

Re: Council Tax

Re: Council Tax

FFD 1:24:00, OMG - a solution for c'tax? lets hope so: stop this sh*t on the most pieceful manner possible? MOB does put forward quite a lot of interesting ideas & possible solutions? What do you all think?

https://www.youtube.com/watch?v=nK-il4m2qxE

https://www.youtube.com/watch?v=nK-il4m2qxE

Last edited by assassin on Sat Oct 09, 2021 6:47 pm; edited 1 time in total (Reason for editing : Language)

LionsShare- Moderator

- Posts : 3288

Join date : 2017-04-26

Location : Literally Where Ever I Am

Re: Council Tax

Re: Council Tax

Where does it come from, the idea that Council Tax should only apply to commercial property? It is not what the LGFA appears to say, and I have never seen anyone point to an alternative definition.

flyingfish- dedicated

- Posts : 884

Join date : 2017-03-22

Re: Council Tax

Re: Council Tax

FF please could you comment on what this could mean?

https://www.legislation.gov.uk/ukpga/1992/14/section/3

3 Meaning of “dwelling".

(1)This section has effect for determining what is a dwelling for the purposes of this Part.

(2)Subject to the following provisions of this section, a dwelling is any property which—

(a)by virtue of the definition of hereditament in section 115(1) of the M1General Rate Act 1967, would have been a hereditament for the purposes of that Act if that Act remained in force; and

(b)is not for the time being shown or required to be shown in a local or a central non-domestic rating list in force at that time; and

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

rating list

From https://www.valuationtribunal.gov.uk/jargon-buster-faqs/jargon-buster/

Rateable value

Valuation Officers determine a rateable value for every non-domestic property in the country. This is used as the basis for the amount of rates that a ratepayer must pay. The rateable value is based on an estimate of the annual rent for the property, that it might reasonably be expected to let for, on the open market, on the antecedent valuation date, subject to various assumptions.

please could you explain what 'non-domestic' might mean from Sect3 2(b) lgfa 1992 above?

https://www.legislation.gov.uk/ukpga/1992/14/section/3

3 Meaning of “dwelling".

(1)This section has effect for determining what is a dwelling for the purposes of this Part.

(2)Subject to the following provisions of this section, a dwelling is any property which—

(a)by virtue of the definition of hereditament in section 115(1) of the M1General Rate Act 1967, would have been a hereditament for the purposes of that Act if that Act remained in force; and

(b)is not for the time being shown or required to be shown in a local or a central non-domestic rating list in force at that time; and

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

rating list

From https://www.valuationtribunal.gov.uk/jargon-buster-faqs/jargon-buster/

Rateable value

Valuation Officers determine a rateable value for every non-domestic property in the country. This is used as the basis for the amount of rates that a ratepayer must pay. The rateable value is based on an estimate of the annual rent for the property, that it might reasonably be expected to let for, on the open market, on the antecedent valuation date, subject to various assumptions.

please could you explain what 'non-domestic' might mean from Sect3 2(b) lgfa 1992 above?

LionsShare- Moderator

- Posts : 3288

Join date : 2017-04-26

Location : Literally Where Ever I Am

Re: Council Tax

Re: Council Tax

Sure. The terminology used there goes round in circles, but it gets there in the end. It could certainly have been more clearly worded to avoid double negatives but we can step through it as follows ..

(1) Non-Domestic means not domestic, I think that's clear enough.

(2) The clause you mention says ..

"(b) is not for the time being shown or required to be shown in a local or a central non-domestic rating list in force at that time; and"

(3) Any sort of list described as "non-domestic" is going to be a list of things that are "non-domestic", and as we've seen in (1) that means not domestic.

(4) Taking this together it means a normal home which I hope we all agree is "domestic", is not "non-domestic" and therefore won't appear on that rating list.

I suppose in any given case you could actually look on the rating list and see if your property appears there. If it's a normal house or flat used as someone's home, whether rented or owned, then it won't appear. But if the owner started to use that same property as for example a holiday let, then it is no longer domestic and would be subject to Rates rather than Council Tax.

https://www.tax.service.gov.uk/business-rates-find/list-properties

Hope that's reasonably clear, let me know if not.

(1) Non-Domestic means not domestic, I think that's clear enough.

(2) The clause you mention says ..

"(b) is not for the time being shown or required to be shown in a local or a central non-domestic rating list in force at that time; and"

(3) Any sort of list described as "non-domestic" is going to be a list of things that are "non-domestic", and as we've seen in (1) that means not domestic.

(4) Taking this together it means a normal home which I hope we all agree is "domestic", is not "non-domestic" and therefore won't appear on that rating list.

I suppose in any given case you could actually look on the rating list and see if your property appears there. If it's a normal house or flat used as someone's home, whether rented or owned, then it won't appear. But if the owner started to use that same property as for example a holiday let, then it is no longer domestic and would be subject to Rates rather than Council Tax.

https://www.tax.service.gov.uk/business-rates-find/list-properties

Hope that's reasonably clear, let me know if not.

flyingfish- dedicated

- Posts : 884

Join date : 2017-03-22

Re: Council Tax

Re: Council Tax

Hi FF,

thanks for the link, I have tried the post code given by the local council for c'tax demand received & it does not appear.

Reading that stated above - sect3 2(b) would c'tax & business rates not be 1 & the same thing? Would c'tax only apply to a non-domestic dwelling?

Please note am not legally trained & just simply asking questions.

thanks for the link, I have tried the post code given by the local council for c'tax demand received & it does not appear.

Reading that stated above - sect3 2(b) would c'tax & business rates not be 1 & the same thing? Would c'tax only apply to a non-domestic dwelling?

Please note am not legally trained & just simply asking questions.

LionsShare- Moderator

- Posts : 3288

Join date : 2017-04-26

Location : Literally Where Ever I Am

Re: Council Tax

Re: Council Tax

They are alternatives, business rates apply to some properties, council tax applies to others. Still others may have neither if they don't meet either definition.LionsShare wrote:Reading that stated above - sect3 2(b) would c'tax & business rates not be 1 & the same thing?

Council tax applies to domestic properties, not to non-domestic.Would c'tax only apply to a non-domestic dwelling?

This is all going by what's written in the LGFA. As I posted earlier I don't know what is behind the idea that council tax applies only to non-domestic. It may just be that someone misunderstood that clumsy wording and jumped to the wrong conclusion, then the idea has been passed around without question ever since. I suspect the idea will continue to circulate irrespective of facts, partly I think because CT is a much hated tax and people would love for there to be a loophole.

flyingfish- dedicated

- Posts : 884

Join date : 2017-03-22

Re: Council Tax

Re: Council Tax

you may be correct.flyingfish wrote:I don't know what is behind the idea that council tax applies only to non-domestic. It may just be that someone misunderstood that clumsy wording and jumped to the wrong conclusion,

Would I be correct in assuming without LGFA92 there would be no c'tax? if so the LGFA92 creates the liability. Then the assumption also the LGFA92 creates the ability to lie.flyingfish wrote:I suspect the idea will continue to circulate irrespective of facts, partly I think because CT is a much hated tax and people would love for there to be a loophole.

There is really no debt just simply 'here's a bill, pay it'?

LionsShare- Moderator

- Posts : 3288

Join date : 2017-04-26

Location : Literally Where Ever I Am

Re: Council Tax

Re: Council Tax

Without LGFA 1992 we'd still have the Poll Tax (Community Charge) which on balance was even worse.

flyingfish- dedicated

- Posts : 884

Join date : 2017-03-22

Re: Council Tax

Re: Council Tax

from my memory as the gov't of the day wanted poll tax (& maggie - the bitch) gone, then its pure speculation that tax would still be on the statute books.

LionsShare- Moderator

- Posts : 3288

Join date : 2017-04-26

Location : Literally Where Ever I Am

Re: Council Tax

Re: Council Tax

Its the same for utilities although that will take some comprehension. Sooty waves his magic wond & presto debt is created along with a pack of total lies.LionsShare wrote:Would I be correct in assuming without LGFA92 there would be no c'tax? if so the LGFA92 creates the liability. Then the assumption also the LGFA92 creates the ability to lie.

There is really no debt just simply 'here's a bill, pay it'?

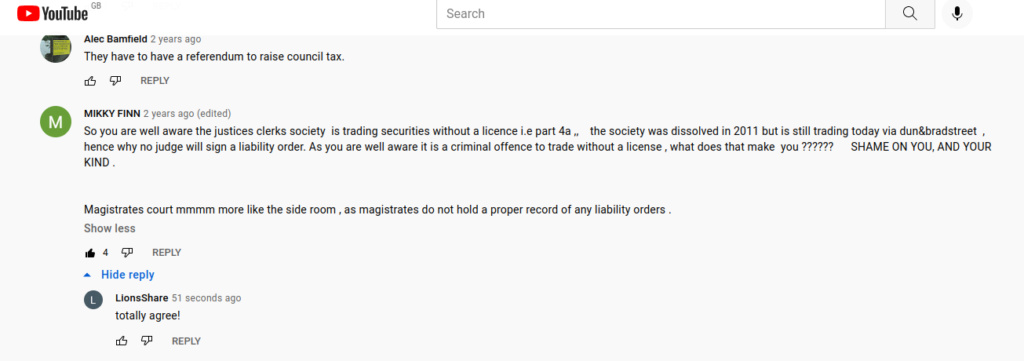

We are being lied to all the time by the 'State', c'tax, utilities, CV19 BS, & here is another - posted before example - of what I mean:

don't forget webster report in about 1 hr 8pm:

LionsShare- Moderator

- Posts : 3288

Join date : 2017-04-26

Location : Literally Where Ever I Am

daveiron likes this post

LionsShare- Moderator

- Posts : 3288

Join date : 2017-04-26

Location : Literally Where Ever I Am

LionsShare- Moderator

- Posts : 3288

Join date : 2017-04-26

Location : Literally Where Ever I Am

Re: Council Tax

Re: Council Tax

I'll just revise my earlier comment if that's OK, since I didn't really answer your specific question ..

Yes you're correct, LGFA 1992 created Council Tax so without it Council Tax would not exist. Similarly the provisions of LGFA 1992 are used to decide who is liable. I'll leave your last point as I am not convinced there is any mileage in re-engineering words. To my mind if you change a word, it becomes a different word, with potentially a different meaning.Would I be correct in assuming without LGFA92 there would be no c'tax? if so the LGFA92 creates the liability. Then the assumption also the LGFA92 creates the ability to lie.

flyingfish- dedicated

- Posts : 884

Join date : 2017-03-22

Re: Council Tax

Re: Council Tax

FF glad you liked it?

LionsShare- Moderator

- Posts : 3288

Join date : 2017-04-26

Location : Literally Where Ever I Am

Re: Council Tax

Re: Council Tax

How many people would genuinely happily pay this tax if they knew

a) where their money (energy) went;

and b) that no theft or imprisonment would follow non-payment;

i wonder ?

a) where their money (energy) went;

and b) that no theft or imprisonment would follow non-payment;

i wonder ?

urchinatheart- Moderator

- Posts : 210

Join date : 2017-02-05

assassin and LionsShare like this post

Re: Council Tax

Re: Council Tax

Ive heard that council tax is very difficult to cancel & it can take a few years & mayb get put into prison if you dont pay,is this true? Thanks in advance for your reply.

Msyms- Newb

- Posts : 4

Join date : 2021-10-10

Re: Council Tax

Re: Council Tax

May i suggest you keep an eye on the Observation Deck channel on YT

his work on council tax is due in about 2 weeks.

his work on council tax is due in about 2 weeks.

daveiron- Admin

- Posts : 4987

Join date : 2017-01-17

assassin and LionsShare like this post

Re: Council Tax

Re: Council Tax

Hi,do you have a link for this as i csnt seem to find it..i watched a video last night on “get out of debt free” i cant find the original site so has it changed? Jon who created the site said there was lots of help & templates available,i cant find anything myself,any help would be welcome

Msyms- Newb

- Posts : 4

Join date : 2021-10-10

Re: Council Tax

Re: Council Tax

http://getoutofdebtfree.orgMsyms wrote:Hi,do you have a link for this as i csnt seem to find it..i watched a video last night on “get out of debt free” i cant find the original site so has it changed? Jon who created the site said there was lots of help & templates available,i cant find anything myself,any help would be welcome

after trying this you will get redirected, its gone!

LionsShare- Moderator

- Posts : 3288

Join date : 2017-04-26

Location : Literally Where Ever I Am

Msyms likes this post

Re: Council Tax

Re: Council Tax

https://www.legislation.gov.uk/ukpga/1992/14/contentsMsyms wrote:Ive heard that council tax is very difficult to cancel & it can take a few years & mayb get put into prison if you dont pay,is this true? Thanks in advance for your reply.

if you are having problems with c'tax get help as soon as... If you default THEY will come after you & you will be 'done' over, its NO joke, its in the Act you may be sent to prison for none payment.

Please research the legal meaning of 'may'.

LionsShare- Moderator

- Posts : 3288

Join date : 2017-04-26

Location : Literally Where Ever I Am

daveiron, assassin and Msyms like this post

Re: Council Tax

Re: Council Tax

I was lead to believe its all a fraud? There is a letter process to complete,some say prison & goods taken away when you dont pay but some say they beat the council,im not sure what yo believe cant seem to find free help,the link above want money!

Msyms- Newb

- Posts : 4

Join date : 2021-10-10

Re: Council Tax

Re: Council Tax

Msyms Hi,

As I have stated in the posts in this thread, c'tax is nothing other than extortion - pay up or else - its no different to the local mafia or mobsters running the show. The only difference might be no broken arms & legs. The LGFA92 is put in place so that if you don't pay its 'oo look we have a set of rules (legislation) to do people over for none payment'.

Yes without doubt its fraud but, its like competing with the village idiot - the idiot is always right. We will always lose in this bent, rigged, corrupt system.

The following is simple but difficult to get 1's head around - the GBP - '£' is a promise to pay, so by defintion its NOT money & we all NEVER pay for anything, we all work for nothing, get everything for free & yet people get put through all sorts of hell for nothing.

It starts with reading a bank note - cash instrument - say a £5 note, where it states 'BANK OF ENGLAND' underneath it states, 'promises to bearer on demand the sum of £5'. Question to you Mysms what exactly is the 'sum of £5'?

LS

As I have stated in the posts in this thread, c'tax is nothing other than extortion - pay up or else - its no different to the local mafia or mobsters running the show. The only difference might be no broken arms & legs. The LGFA92 is put in place so that if you don't pay its 'oo look we have a set of rules (legislation) to do people over for none payment'.

Yes without doubt its fraud but, its like competing with the village idiot - the idiot is always right. We will always lose in this bent, rigged, corrupt system.

The following is simple but difficult to get 1's head around - the GBP - '£' is a promise to pay, so by defintion its NOT money & we all NEVER pay for anything, we all work for nothing, get everything for free & yet people get put through all sorts of hell for nothing.

It starts with reading a bank note - cash instrument - say a £5 note, where it states 'BANK OF ENGLAND' underneath it states, 'promises to bearer on demand the sum of £5'. Question to you Mysms what exactly is the 'sum of £5'?

LS

LionsShare- Moderator

- Posts : 3288

Join date : 2017-04-26

Location : Literally Where Ever I Am

daveiron and assassin like this post

Page 1 of 2 • 1, 2

Page 1 of 2

Permissions in this forum:

You cannot reply to topics in this forum