Search

Latest topics

» A Parcel sent to me worth 99p ! Court Claim received !by memegirl777 Sun Nov 03, 2024 4:53 pm

» UK Courts Using Faulty Cell Site Data a Serious Concern!!

by midnight Sun Nov 03, 2024 1:32 pm

» Clowells continue

by Biggiebest Sat Nov 02, 2024 11:47 am

» Legal responsibility

by Biggiebest Fri Nov 01, 2024 12:36 pm

» Composting Leaves

by assassin Thu Oct 31, 2024 4:25 am

» Composting

by assassin Thu Oct 31, 2024 4:22 am

» Brandon Joe Williams

by grams Tue Oct 29, 2024 10:16 am

» BEWARE OF TSB BANK

by daveiron Sun Oct 27, 2024 4:04 am

» Council Tax

by Lopsum Thu Oct 24, 2024 2:57 pm

» Salary Finance

by daveiron Thu Oct 24, 2024 10:56 am

» DWP

by daveiron Thu Oct 24, 2024 10:49 am

» Real Electric Cars

by assassin Sun Oct 20, 2024 3:53 am

» BOMBSHELL: Slovakia could BAN mRNA vaccines

by assassin Sun Oct 20, 2024 2:40 am

» Council Tax (getting answers)

by assassin Tue Oct 15, 2024 5:22 pm

» DSAR DELAYS

by daveiron Sun Oct 06, 2024 11:20 pm

» For those considering ,conditional acceptance

by daveiron Fri Oct 04, 2024 9:55 am

» Just got a letter

by daveiron Thu Oct 03, 2024 11:46 pm

» Ceder so called bailiffs

by Ian4644 Mon Sep 30, 2024 2:43 pm

» Our Little Food Growing Experiment

by assassin Fri Sep 27, 2024 5:01 am

» Jocabs Threatening my parents address over council tax.

by darkfireblade Mon Sep 23, 2024 9:42 pm

» Heat Your Home

by assassin Mon Sep 23, 2024 3:48 am

» Purchased Used car, thew con rod after 4 weeks, 40,000mi on clock, can we get out of the finance?

by scrwm Thu Sep 19, 2024 5:56 pm

» ULEZ London huge fine for misunderstanding

by urchinatheart Sat Sep 07, 2024 9:56 pm

» The new ruling, lie-ability order

by assassin Sat Sep 07, 2024 4:19 am

» Prepping 1 Lighting Overview

by assassin Fri Sep 06, 2024 4:34 am

» Prepping 2 Selecting Light Sources

by assassin Fri Sep 06, 2024 4:26 am

» Prepping 3 Security

by assassin Fri Sep 06, 2024 4:21 am

» Prepping 4 Planning Your Lighting

by assassin Fri Sep 06, 2024 4:18 am

» Prepping 5 Charging Your Batteries

by assassin Fri Sep 06, 2024 4:15 am

» An idea to reform the police ?

by assassin Fri Sep 06, 2024 4:02 am

» Post 2007 CCA

by Biggiebest Thu Sep 05, 2024 1:47 pm

» Travel advice please: London to Amsterdam no injects no tests

by Kaddabriol Wed Sep 04, 2024 10:39 am

» CCJ letter

by waylander62 Mon Sep 02, 2024 9:12 pm

» Disability

by assassin Sun Sep 01, 2024 3:03 am

» It works (Richard Vobes)

by assassin Sun Sep 01, 2024 2:57 am

» Veronica Chapmans approach to CT

by daveiron Thu Aug 29, 2024 11:17 pm

» Tsb many times refused basic account

by flyingfish Thu Aug 29, 2024 11:53 am

» Lowell New Address

by waylander62 Tue Aug 27, 2024 7:41 pm

» The Daily Mail doesn't know the law on facemasks and disability -ThatguyScottWeb

by Emma78 Mon Aug 26, 2024 9:29 am

» DSAR from OC

by waylander62 Mon Aug 19, 2024 8:46 pm

» HSBC advice please.

by Trishiapp28 Thu Aug 15, 2024 6:30 pm

» Council Tax Notice of Enforcement

by Lopsum Sun Aug 11, 2024 5:26 pm

» If The State is Pushing You to Riot , Do the Reverse

by Lopsum Sun Aug 11, 2024 5:16 pm

» Grid Down Mistakes To Avoid

by assassin Tue Aug 06, 2024 5:05 am

» Grid Down Realities

by assassin Tue Aug 06, 2024 4:57 am

» Lowest of Lowest continue with their fraud

by assassin Mon Aug 05, 2024 3:09 am

» Government Prepping Food and Water

by assassin Mon Aug 05, 2024 3:07 am

» Subject access dca refused

by daveiron Sat Jul 27, 2024 12:14 am

» Pre action protocol

by Biggiebest Fri Jul 26, 2024 3:40 am

» DCA working on behalf of an energy company

by daveiron Mon Jul 22, 2024 11:45 pm

» More of the Same

by daveiron Sun Jul 21, 2024 12:19 am

» Off Grid Engine Projects

by assassin Sat Jul 20, 2024 5:03 am

» Government Prepping Setting Up

by urchinatheart Wed Jul 17, 2024 8:13 am

» Latest from CrimeBodge

by assassin Tue Jul 16, 2024 4:15 am

» CLAIM FROM NORTHAMPTON

by Biggiebest Wed Jul 03, 2024 9:58 pm

Moon phases

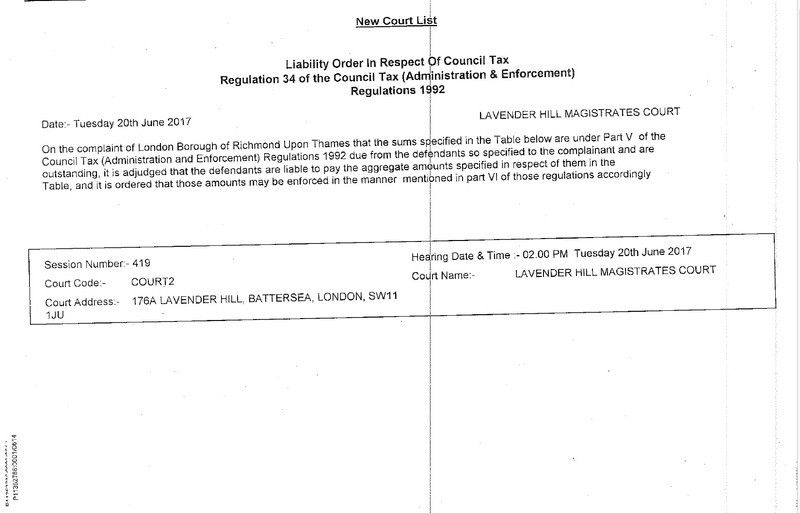

Liability Order in Respect of Council Tax....

+12

Lansdowne

Candor

midnight

Waffle

Ferry Man

Lopsum

Little D

landlubber

Jinxer

LionsShare

daveiron

NoSurender

16 posters

Page 2 of 7

Page 2 of 7 •  1, 2, 3, 4, 5, 6, 7

1, 2, 3, 4, 5, 6, 7

Re: Liability Order in Respect of Council Tax....

Re: Liability Order in Respect of Council Tax....

Hi Guys, Well thought I would give you an update on the progress..!

Below is my email to them and below that is their reply...

For the Attention of the CEO of Richmond Borough Council Paul Martin,

Thank you for your letter dated 21/06/2017, informing my that you have a Liability Order in respect of Council Tax.

Sorry though I require a little more information.

I would like a certified copy of this Liability Order not a letter telling me you have one, that is clearly signed in wet ink by a Judge or Justice of the Peace with their name written in block letters below it.

Can you also tell me now Council tax can be applied to a dwelling that is used for living purposes only?

Thanks.....

THEIR REPLY...

Dear Mr ,

Thank you for your email.

The Council is only required to give the notice that you have received. It is formal notification of the action that the Council took and the resulting outcome of the Court hearing after issuance of the related summons on 23 May last.

You did not attend the hearing and a liability order was obtained. Your details were included in the June hearing list. This was part of a bulk application relating to a number of different cases and so the signed order is a singular one obtained for all cases rather than individually. Please see the attached for reference.

Council Tax is applied to all residential properties, unless they are out of rating or fall under a class whereby they are exempted under Council Tax regulations.

The full annual charge can be reduced by a single occupancy discount and any council tax reduction applicable to eligible claimants. I see from your account that both have been granted to you. Please refer to your annual bill for details of your own entitlements. Be aware, however, that council tax reduction this year is only applicable to 85% of the remaining charge after any single occupancy discount has been granted. You are still responsible to pay 15% of the remaining charge for the current year. You did not make the required payment of the instalments as per your annual bill hence you received a reminder notice and later a summons.

I note that you appear to be still in receipt of job seekers allowance, and therefore the Council will seek recovery of the debt owed by applying to the Department for Work and Pensions for an Attachment of Benefit. I also note that you have previous year arrears that have yet to be cleared and so the attachment will seek to reduce those in the first instance.

I trust the above is of assistance.

Kind regards,

Clive Beard

Principal Recovery Officer

Recovery & Valuation

Revenues & Benefits

London Borough of Richmond-upon-Thames

Finance & Corporate Services

Civic Centre

44 York Street

Twickenham

Middx TW1 3BZ

Tel: 0208 891 7943

Fax: 0208 891 7934

E-mail: c.beard@richmond.gov.uk

Below is my email to them and below that is their reply...

For the Attention of the CEO of Richmond Borough Council Paul Martin,

Thank you for your letter dated 21/06/2017, informing my that you have a Liability Order in respect of Council Tax.

Sorry though I require a little more information.

I would like a certified copy of this Liability Order not a letter telling me you have one, that is clearly signed in wet ink by a Judge or Justice of the Peace with their name written in block letters below it.

Can you also tell me now Council tax can be applied to a dwelling that is used for living purposes only?

Thanks.....

THEIR REPLY...

Dear Mr ,

Thank you for your email.

The Council is only required to give the notice that you have received. It is formal notification of the action that the Council took and the resulting outcome of the Court hearing after issuance of the related summons on 23 May last.

You did not attend the hearing and a liability order was obtained. Your details were included in the June hearing list. This was part of a bulk application relating to a number of different cases and so the signed order is a singular one obtained for all cases rather than individually. Please see the attached for reference.

Council Tax is applied to all residential properties, unless they are out of rating or fall under a class whereby they are exempted under Council Tax regulations.

The full annual charge can be reduced by a single occupancy discount and any council tax reduction applicable to eligible claimants. I see from your account that both have been granted to you. Please refer to your annual bill for details of your own entitlements. Be aware, however, that council tax reduction this year is only applicable to 85% of the remaining charge after any single occupancy discount has been granted. You are still responsible to pay 15% of the remaining charge for the current year. You did not make the required payment of the instalments as per your annual bill hence you received a reminder notice and later a summons.

I note that you appear to be still in receipt of job seekers allowance, and therefore the Council will seek recovery of the debt owed by applying to the Department for Work and Pensions for an Attachment of Benefit. I also note that you have previous year arrears that have yet to be cleared and so the attachment will seek to reduce those in the first instance.

I trust the above is of assistance.

Kind regards,

Clive Beard

Principal Recovery Officer

Recovery & Valuation

Revenues & Benefits

London Borough of Richmond-upon-Thames

Finance & Corporate Services

Civic Centre

44 York Street

Twickenham

Middx TW1 3BZ

Tel: 0208 891 7943

Fax: 0208 891 7934

E-mail: c.beard@richmond.gov.uk

NoSurender- Not so newb

- Posts : 26

Join date : 2017-06-26

Re: Liability Order in Respect of Council Tax....

Re: Liability Order in Respect of Council Tax....

I think I would follow that up with the questions.

'What is the councils definition of

1. A dwelling

2. A residential Property.

3. Where is the printed name of the J.O.P. or Court Clerk who signed the order and therefor takes liability for it ?

'What is the councils definition of

1. A dwelling

2. A residential Property.

3. Where is the printed name of the J.O.P. or Court Clerk who signed the order and therefor takes liability for it ?

daveiron- Admin

- Posts : 4984

Join date : 2017-01-17

Re: Liability Order in Respect of Council Tax....

Re: Liability Order in Respect of Council Tax....

daveiron wrote:I think I would follow that up with the questions.

'What is the councils definition of

1. A dwelling

2. A residential Property.

3. Where is the printed name of the J.O.P. or Court Clerk who signed the order and therefor takes liability for it ?

Lovely...lets see where this takes us..?!

Thank you

NoSurender- Not so newb

- Posts : 26

Join date : 2017-06-26

Re: Liability Order in Respect of Council Tax....

Re: Liability Order in Respect of Council Tax....

This has worked in the past

Jinxer- Very helpful

- Posts : 436

Join date : 2017-06-03

Re: Liability Order in Respect of Council Tax....

Re: Liability Order in Respect of Council Tax....

Number of liability orders 1374.

Costs to be awarded in each case £26.50.

1374 X £26.50 = £36,411.00

The reply from Mr Clive Beard states that "Your details were included in the June hearing list. This was part of a bulk application relating to a number of different cases and so the signed order is a singular one obtained for all cases rather than individually." So the cost of one singular bulk order cost the council £36,411.00.

I seem to recall from the old GOODF site that they can only claim their actual costs. As it was awhile ago then does anyone else recall the detail's of this. I think that there may have been a court case over it and that it was brought by a vicar. I'm not into council tax myself so I maybe mistaken.

Costs to be awarded in each case £26.50.

1374 X £26.50 = £36,411.00

The reply from Mr Clive Beard states that "Your details were included in the June hearing list. This was part of a bulk application relating to a number of different cases and so the signed order is a singular one obtained for all cases rather than individually." So the cost of one singular bulk order cost the council £36,411.00.

I seem to recall from the old GOODF site that they can only claim their actual costs. As it was awhile ago then does anyone else recall the detail's of this. I think that there may have been a court case over it and that it was brought by a vicar. I'm not into council tax myself so I maybe mistaken.

midnight- Very helpful

- Posts : 252

Join date : 2017-05-25

Age : 61

Location : Wisbech

Re: Liability Order in Respect of Council Tax....

Re: Liability Order in Respect of Council Tax....

Hi No surrender

Thanks for posting this reply Clive Beards reply is very useful, in particular, where says:

"Council Tax is applied to all residential properties, unless they are out of rating or fall under a class whereby they are exempted under Council Tax regulations."

Notice how he uses the word applied, in other words he tells us what the Councils apply, not what the law (statute) defines as a chargeable dwelling, there is no reference or definition to the words residential property or even the word residence in the 1992 LGFA or the preceding and inter-related acts in that regard either. (don't take my word on that please verify yourselves)

Hard to say whether he was being deliberately vague and using his interpretation to suit or he is generally as dissonant of the law as most Council officers now are.

"Unless they are out of rating" what is they ? what is Residential PROPERTY ? How about Domestic Dwellings ? What does he mean by taken out of rating exactly ?

Questions one may wish to ask, but be warned there is certain information that can be and will be disclosed in some situations and circumstances that in others will not be, essentially based on criteria such as Council Corporate Policy and how you are perceived, in other words FOI requests that have a wiff of "I am a freeman on the land" about them will most certainly be ignored or circumvented. There is information a VOA agent may disclose that a Council Officer will not and so on.

I think Council Tax is best sized up by asking the right questions very precisely and incisively and not allowing these people room to wriggle out of it, at a far simpler level you could ask, that if the 1992 LGFA (which is what councils claim gives them statutory power to charge C Tax) refers to rates as Non Domestic (which it does) and NOT Domestic (which it doesn't) why and how do Domestic Dwellings attract a Non Domestic Rating Charge ?

The truth is they don't, which is why its called Non Domestic rates, note the words used, the legislator intended Non Domestic rates to be the subject of the enactment, and the judiciary must interpret the same as the legislator intended, not that this is a grey area - its expressed in plain sight. So this is where you have to be prepared to adapt your perspective on how the law is being apparently circumvented as defined in a statutory provision its a given that in the magistrates court a liability order is a foregone conclusion you are automatically guilty by the time the matter gets that far, I don't think there is any doubt on that rubber stamping - quasi criminal circus being the shitty end of the stick, no matter what you do or say, by then its too late the robots taken over.

I will post a better document on this statutory anomaly in due course.

This reply from Mr Beard helps me a lot with my own research within the council and the VOA, so I appreciate you posting it.

Cheers

Thanks for posting this reply Clive Beards reply is very useful, in particular, where says:

"Council Tax is applied to all residential properties, unless they are out of rating or fall under a class whereby they are exempted under Council Tax regulations."

Notice how he uses the word applied, in other words he tells us what the Councils apply, not what the law (statute) defines as a chargeable dwelling, there is no reference or definition to the words residential property or even the word residence in the 1992 LGFA or the preceding and inter-related acts in that regard either. (don't take my word on that please verify yourselves)

Hard to say whether he was being deliberately vague and using his interpretation to suit or he is generally as dissonant of the law as most Council officers now are.

"Unless they are out of rating" what is they ? what is Residential PROPERTY ? How about Domestic Dwellings ? What does he mean by taken out of rating exactly ?

Questions one may wish to ask, but be warned there is certain information that can be and will be disclosed in some situations and circumstances that in others will not be, essentially based on criteria such as Council Corporate Policy and how you are perceived, in other words FOI requests that have a wiff of "I am a freeman on the land" about them will most certainly be ignored or circumvented. There is information a VOA agent may disclose that a Council Officer will not and so on.

I think Council Tax is best sized up by asking the right questions very precisely and incisively and not allowing these people room to wriggle out of it, at a far simpler level you could ask, that if the 1992 LGFA (which is what councils claim gives them statutory power to charge C Tax) refers to rates as Non Domestic (which it does) and NOT Domestic (which it doesn't) why and how do Domestic Dwellings attract a Non Domestic Rating Charge ?

The truth is they don't, which is why its called Non Domestic rates, note the words used, the legislator intended Non Domestic rates to be the subject of the enactment, and the judiciary must interpret the same as the legislator intended, not that this is a grey area - its expressed in plain sight. So this is where you have to be prepared to adapt your perspective on how the law is being apparently circumvented as defined in a statutory provision its a given that in the magistrates court a liability order is a foregone conclusion you are automatically guilty by the time the matter gets that far, I don't think there is any doubt on that rubber stamping - quasi criminal circus being the shitty end of the stick, no matter what you do or say, by then its too late the robots taken over.

I will post a better document on this statutory anomaly in due course.

This reply from Mr Beard helps me a lot with my own research within the council and the VOA, so I appreciate you posting it.

Cheers

Candor- news worthy

- Posts : 147

Join date : 2017-07-20

Re: Liability Order in Respect of Council Tax....

Re: Liability Order in Respect of Council Tax....

Does this mean or indicate the possibility of being able to NOT pay ctax? If they cannot identify me as am not on electoral role?Ferry Man wrote:I really think their using the identifier "Ward" to locate you on the corporate topography ought to be getting people using this forum to start doing proper research.

"Ward" to me seeing the electoral role list every year, where I live is split into different "Wards"!

Is that too naive & dangerous?

LionsShare- Moderator

- Posts : 3288

Join date : 2017-04-26

Location : Literally Where Ever I Am

Re: Liability Order in Respect of Council Tax....

Re: Liability Order in Respect of Council Tax....

Hi LionsShare

i think with 'ward' he was pointing out that it should be considered an insult to be referred to as such. A 'ward' as it applies to CT districts can be loosely translated as: an area populated by irresponsible children who are incompetent in the management of their own affairs.

When applied to a human it means that that human has no say in their own future.

Yes, removing yourself from the electoral roll is the first step, but there's much more to do.

How far into researching this are you fella? Happy to help, if i can.

Cheers!

i think with 'ward' he was pointing out that it should be considered an insult to be referred to as such. A 'ward' as it applies to CT districts can be loosely translated as: an area populated by irresponsible children who are incompetent in the management of their own affairs.

When applied to a human it means that that human has no say in their own future.

Yes, removing yourself from the electoral roll is the first step, but there's much more to do.

How far into researching this are you fella? Happy to help, if i can.

Cheers!

Guest- Guest

Re: Liability Order in Respect of Council Tax....

Re: Liability Order in Respect of Council Tax....

Hi iamani,

Thanks for the reply. So far have read what “white rabbit” has pointed out, & various others surrounding lgfa 1992/1988, not had too much time to read other legislative publications on their website. Currently helping friends renovate a house with basic pointers regarding plumbing, electrics, painting, etc.

When referencing a “ward” I see what you mean, but always thought it was more akin to non compos mentis people not really being to look after themselves –as oppose to children? I suppose there really isn’t that much difference as far as those damn councils are concerned?

Reading what you have written in various threads compared to what I know, you are streets ahead of me. Currently my expertise is restricted to comprehending that ctax is charged for all dewllings & yes it a lot more than just “non-domestic” or even that ctax should not be charged for residential dewllings. I get the impression (maybe wrong) that ctax is charged as a way of “looking after” the non compos mentis people in the “ward”? Your thoughts? Am I anywhere near?

Regards

Thanks for the reply. So far have read what “white rabbit” has pointed out, & various others surrounding lgfa 1992/1988, not had too much time to read other legislative publications on their website. Currently helping friends renovate a house with basic pointers regarding plumbing, electrics, painting, etc.

When referencing a “ward” I see what you mean, but always thought it was more akin to non compos mentis people not really being to look after themselves –as oppose to children? I suppose there really isn’t that much difference as far as those damn councils are concerned?

Reading what you have written in various threads compared to what I know, you are streets ahead of me. Currently my expertise is restricted to comprehending that ctax is charged for all dewllings & yes it a lot more than just “non-domestic” or even that ctax should not be charged for residential dewllings. I get the impression (maybe wrong) that ctax is charged as a way of “looking after” the non compos mentis people in the “ward”? Your thoughts? Am I anywhere near?

Regards

LionsShare- Moderator

- Posts : 3288

Join date : 2017-04-26

Location : Literally Where Ever I Am

Re: Liability Order in Respect of Council Tax....

Re: Liability Order in Respect of Council Tax....

Hi LionsShare

Yes, to my current understanding you are spot on sherlock! Ferryman asked 3 questions at start of his post - what is it (CT), who COLLECTS it, who is liable. Then lots if clues.

i think it was a replacement for church rates and tithing, and it is businesses of the parish/ward/district that are liable. When you consider that we have all been set up as 'micro-businesses'....

But that leaves several holes, so not sure where it fits in.

i'm also of the opinion that a certain amount of esotericism has been woven into the statutes. Eg: what is a dwelling? Spiritually speaking, we all are a fleshly dwelling of the breath of God......

The thing is buddy, there is no technique by itself which will negate you having to pay CT. You can achieve a stalemate using commerce if you do it right (from what i've seen) which amounts to the same thing, but the council will never tell a human he doesn't have to pay.

Only a 'man' will ever be told that.

Cheers!

Yes, to my current understanding you are spot on sherlock! Ferryman asked 3 questions at start of his post - what is it (CT), who COLLECTS it, who is liable. Then lots if clues.

i think it was a replacement for church rates and tithing, and it is businesses of the parish/ward/district that are liable. When you consider that we have all been set up as 'micro-businesses'....

But that leaves several holes, so not sure where it fits in.

i'm also of the opinion that a certain amount of esotericism has been woven into the statutes. Eg: what is a dwelling? Spiritually speaking, we all are a fleshly dwelling of the breath of God......

The thing is buddy, there is no technique by itself which will negate you having to pay CT. You can achieve a stalemate using commerce if you do it right (from what i've seen) which amounts to the same thing, but the council will never tell a human he doesn't have to pay.

Only a 'man' will ever be told that.

Cheers!

Guest- Guest

Re: Liability Order in Respect of Council Tax....

Re: Liability Order in Respect of Council Tax....

A Man can only have standing in a Court of Equity when he has Property and a Beneficial Claim of interest.

A Man is not told his rights, he exercises them and makes his law accordingly, if you wish to be heard in Court as a Man you better be a Beneficiary with a right of action.

At Law = Form and Fiction

Equity = Substance and Good Conscience

They appear do have done all they can to keep us trapped in the trustee position by default, either through registration, transfer, contract, or whatever else allows them to construe a Debt TITLE upon us.

Claiming to be a Man means nothing, you have to have a Beneficial claim to have standing, that means there must be a Trust, and a trust you can prove to be in place without giving the courts the ability to interpret or construe your trust, because that will be used to work against you not for you..

A Man is not told his rights, he exercises them and makes his law accordingly, if you wish to be heard in Court as a Man you better be a Beneficiary with a right of action.

At Law = Form and Fiction

Equity = Substance and Good Conscience

They appear do have done all they can to keep us trapped in the trustee position by default, either through registration, transfer, contract, or whatever else allows them to construe a Debt TITLE upon us.

Claiming to be a Man means nothing, you have to have a Beneficial claim to have standing, that means there must be a Trust, and a trust you can prove to be in place without giving the courts the ability to interpret or construe your trust, because that will be used to work against you not for you..

Candor- news worthy

- Posts : 147

Join date : 2017-07-20

Re: Liability Order in Respect of Council Tax....

Re: Liability Order in Respect of Council Tax....

Totally agree, with the Human being a person & a MAN being - well a man, there really is not much else to say on that!iamani wrote: but the council will never tell a human he doesn't have to pay.

Only a 'man' will ever be told that.

Cheers!

Regards

LionsShare- Moderator

- Posts : 3288

Join date : 2017-04-26

Location : Literally Where Ever I Am

Re: Liability Order in Respect of Council Tax....

Re: Liability Order in Respect of Council Tax....

After seeing various yt vids over the last few months it now all makes sense. Correct me if am wrong but put simply physically standing in court saying (to the affect) "I the benificiary of the MR./MRS./MS. ALL UPPER CASE CQV TRUST". Literally challenging jurisdiction?Candor wrote:A Man can only have standing in a Court of Equity when he has Property and a Beneficial Claim of interest.

A Man is not told his rights, he exercises them and makes his law accordingly, if you wish to be heard in Court as a Man you better be a Beneficiary with a right of action.

At Law = Form and Fiction

Equity = Substance and Good Conscience

They appear do have done all they can to keep us trapped in the trustee position by default, either through registration, transfer, contract, or whatever else allows them to construe a Debt TITLE upon us.

Claiming to be a Man means nothing, you have to have a Beneficial claim to have standing, that means there must be a Trust, and a trust you can prove to be in place without giving the courts the ability to interpret or construe your trust, because that will be used to work against you not for you..

jurisdiction: my comprehention, juris: have the right to make legal determinations. diction: through the use/study of words (etimology). That's why in court what ever evidence is produced especially when referring to statute/acts, what is contained in the body of words the judge can "see".

LionsShare- Moderator

- Posts : 3288

Join date : 2017-04-26

Location : Literally Where Ever I Am

Re: Liability Order in Respect of Council Tax....

Re: Liability Order in Respect of Council Tax....

iamani wrote:Hi LionsShare

Yes, to my current understanding you are spot on sherlock! Ferryman asked 3 questions at start of his post - what is it (CT), who COLLECTS it, who is liable. Then lots if clues.

i think it was a replacement for church rates and tithing, and it is businesses of the parish/ward/district that are liable. When you consider that we have all been set up as 'micro-businesses'....

But that leaves several holes, so not sure where it fits in.

Cheers!

Iamani, you must be too young to remember Mrs Thatcher. She introduced the Poll Tax to replace rates, and when the riots never stopped, poll tax was replaced by Council Tax a few years later. But all those changes were for residential properties. Businesses, schools, charities etc. still get charged "rates".

I don't remember ever hearing about "properties out of rating" but I'm guessing some examples might be nursing homes, campus student accommodation, or a caretaker's flat in an office building or factory, all of those are residential but owned by a business that pays rates.

Lansdowne- Not so newb

- Posts : 10

Join date : 2017-07-17

Re: Liability Order in Respect of Council Tax....

Re: Liability Order in Respect of Council Tax....

That's a relevant observation, but you are speaking about residential Property, if you look at my other post on Residence and Domicile you may find it has a specific meaning that is not synonymous with the colloquial way in which we use the term Residential.

Not withstanding Residential Property is not synonymous with Domestic Dwellings, indeed Residential Property is not defined in the LGFA but a Domestic Dwelling is, don't take my word for it though have a read through LGFA 1992, 1988 and the 1967 GRA and tell me what the definition of Residential property is, I guarantee it is not what you think it is.

1988 LGFA:

66

Domestic property.

.

(1)

[F141Subject to subsections (2), (2B) and 2E below], property is domestic if—

.

(a)

it is used wholly for the purposes of living accommodation, there you go, Domestic property not residential property.

And look at this here for a clue:-

[F150(8A)

In this section—

.

“business” includes—

(a)

any activity carried on by a body of persons, whether corporate or unincorporate, and

.

(b)

any activity carried on by a charity;

.

“commercially” means on a commercial basis, and with a view to the realisation of profits; and

“relevant leasehold interest” means an interest under a lease or underlease which was granted for a term of 6 months or more and conferred the right to exclusive possession throughout the term.]

I hope you are starting to see the value of actually reading this stuff, because I sure do, and I can see we are being deceived by certain words used and the avoidance of other certain words.

Notwithstanding the fact your average Council Revenues Dick probably have no knowledge of it really, go and ask these people and you will find out, I did and I discovered way more than I would arguing like a freeman, one must use a bit of tact with these things because you can use the compartmentalised structure of these corporations and the knowledge layering to your advantage if your wise.

There was a reason why I highlighted "taken out of rating" , if you look at a valuation list or read the 1967 GRA you will no why.

Remember presuming and assuming is the mother of all .... ... ! Read Enquire Verify, REV my new acronym don't bite it .

Not withstanding Residential Property is not synonymous with Domestic Dwellings, indeed Residential Property is not defined in the LGFA but a Domestic Dwelling is, don't take my word for it though have a read through LGFA 1992, 1988 and the 1967 GRA and tell me what the definition of Residential property is, I guarantee it is not what you think it is.

1988 LGFA:

66

Domestic property.

.

(1)

[F141Subject to subsections (2), (2B) and 2E below], property is domestic if—

.

(a)

it is used wholly for the purposes of living accommodation, there you go, Domestic property not residential property.

And look at this here for a clue:-

[F150(8A)

In this section—

.

“business” includes—

(a)

any activity carried on by a body of persons, whether corporate or unincorporate, and

.

(b)

any activity carried on by a charity;

.

“commercially” means on a commercial basis, and with a view to the realisation of profits; and

“relevant leasehold interest” means an interest under a lease or underlease which was granted for a term of 6 months or more and conferred the right to exclusive possession throughout the term.]

I hope you are starting to see the value of actually reading this stuff, because I sure do, and I can see we are being deceived by certain words used and the avoidance of other certain words.

Notwithstanding the fact your average Council Revenues Dick probably have no knowledge of it really, go and ask these people and you will find out, I did and I discovered way more than I would arguing like a freeman, one must use a bit of tact with these things because you can use the compartmentalised structure of these corporations and the knowledge layering to your advantage if your wise.

There was a reason why I highlighted "taken out of rating" , if you look at a valuation list or read the 1967 GRA you will no why.

Remember presuming and assuming is the mother of all .... ... ! Read Enquire Verify, REV my new acronym don't bite it .

Candor- news worthy

- Posts : 147

Join date : 2017-07-20

Re: Liability Order in Respect of Council Tax....

Re: Liability Order in Respect of Council Tax....

Could someone explain what does GRA standfor?

LionsShare- Moderator

- Posts : 3288

Join date : 2017-04-26

Location : Literally Where Ever I Am

Re: Liability Order in Respect of Council Tax....

Re: Liability Order in Respect of Council Tax....

General Rate Act

Jinxer- Very helpful

- Posts : 436

Join date : 2017-06-03

Re: Liability Order in Respect of Council Tax....

Re: Liability Order in Respect of Council Tax....

ThanksJinxer wrote:General Rate Act

LionsShare- Moderator

- Posts : 3288

Join date : 2017-04-26

Location : Literally Where Ever I Am

Re: Liability Order in Respect of Council Tax....

Re: Liability Order in Respect of Council Tax....

Hi all

Candor - enjoying your posts, interesting content, couple of queries: who said anything about 'claiming' to be a man? and: are CT issues dealt with in equity? Thanks.

LionsShare - you seem to be covering the same ground i did, keep going - it gets SO much more interesting. Don't be tempted to skate over the subject of 'man'-hood, it is key to EVERYTHING you seek . Oh, btw - jurisdiction = the right to dictate terms, the right to tell you what to do.

Lansdowne - i remember who took my milk away just fine, thanks! As you say, businesses, schools charities etc paid rates then and now. Poll tax was an attempt at launching 'person'-al taxation on the sleeping public. Woke up pretty quick, didn't they? Ha!

Re: 'properties out of rating' - i suspect we need to think 'church'....?

Cheers!

Candor - enjoying your posts, interesting content, couple of queries: who said anything about 'claiming' to be a man? and: are CT issues dealt with in equity? Thanks.

LionsShare - you seem to be covering the same ground i did, keep going - it gets SO much more interesting. Don't be tempted to skate over the subject of 'man'-hood, it is key to EVERYTHING you seek . Oh, btw - jurisdiction = the right to dictate terms, the right to tell you what to do.

Lansdowne - i remember who took my milk away just fine, thanks! As you say, businesses, schools charities etc paid rates then and now. Poll tax was an attempt at launching 'person'-al taxation on the sleeping public. Woke up pretty quick, didn't they? Ha!

Re: 'properties out of rating' - i suspect we need to think 'church'....?

Cheers!

Guest- Guest

Re: Liability Order in Respect of Council Tax....

Re: Liability Order in Respect of Council Tax....

Interesting final pointer Lamani stick parochial in front of that, then council after, then we would be looking at equity, you would just appoint the trustee for your charitable land. Although I still like the diplomat theory

Waffle- dedicated

- Posts : 786

Join date : 2017-03-27

Re: Liability Order in Respect of Council Tax....

Re: Liability Order in Respect of Council Tax....

Hi Waffle

Ha! i'm sure we can all be diplomats!

i'm gonna have to pick it up as i go along re: equity, i've yet to study it. Good job you guys know what you're talking about.

Charitable, you say..... hmmmm.

Cheers!

Ha! i'm sure we can all be diplomats!

i'm gonna have to pick it up as i go along re: equity, i've yet to study it. Good job you guys know what you're talking about.

Charitable, you say..... hmmmm.

Cheers!

Guest- Guest

Re: Liability Order in Respect of Council Tax....

Re: Liability Order in Respect of Council Tax....

@ iamanai

Yes I said claim to be a man and not you, however it follows from your comment by implicit logic that you are referring to a Man in his primary or naked sense regards law.

I suggest to you that A man can only enforce rights in the courts by appearing in the appropiate persona with relation to property, thus a man is never told his rights, he exercises them and if he enforces them in the correct jurisdiction and venue they are recognised, in theory anyway.

Equity assists where a Trust is in place and a beneficiary is recognised, regards Council Tax you might ask yourself is there a Beneficiary and if there is, it follows there must also be a trust structure and relationship in place.

The Council create an account and join your PERSON to it, when ever that account has payments made to it, that makes the council or Billing Authority a Beneficiary, if you are the one being told you have no choice but to make the payments you must be the Trustee.

On the face of it there appears to be an "at law" issue by its form, regarding a statutory provision, in substance there is something completely different.

So my answer is yes, but the relationship of parties to property needs to be unpicked and we have to completely rethink our position in all of this.

Yes I said claim to be a man and not you, however it follows from your comment by implicit logic that you are referring to a Man in his primary or naked sense regards law.

I suggest to you that A man can only enforce rights in the courts by appearing in the appropiate persona with relation to property, thus a man is never told his rights, he exercises them and if he enforces them in the correct jurisdiction and venue they are recognised, in theory anyway.

Equity assists where a Trust is in place and a beneficiary is recognised, regards Council Tax you might ask yourself is there a Beneficiary and if there is, it follows there must also be a trust structure and relationship in place.

The Council create an account and join your PERSON to it, when ever that account has payments made to it, that makes the council or Billing Authority a Beneficiary, if you are the one being told you have no choice but to make the payments you must be the Trustee.

On the face of it there appears to be an "at law" issue by its form, regarding a statutory provision, in substance there is something completely different.

So my answer is yes, but the relationship of parties to property needs to be unpicked and we have to completely rethink our position in all of this.

Candor- news worthy

- Posts : 147

Join date : 2017-07-20

Re: Liability Order in Respect of Council Tax....

Re: Liability Order in Respect of Council Tax....

Example;

Accomodation for living purposes only = Could the purpose of living or the accommodation for living be trust property, can the Billing Authority claim your "living" is property that they have ownership of ?

Body of Persons, Corporate or unincorporated = Now that does sound like trust language to me, you have a Body or Corpus, that is the trust.

Any activity carried on by = the purpose of the trust, albeit very general, the body of the trust must specify the parties thereto.

The secretary of State (the Estate) gets to amend or define the law of the trust which is expressly revocable so he must be the settlor, that just leaves the beneficiaries and the trustees and possibly the administrators or executors.

Accomodation for living purposes only = Could the purpose of living or the accommodation for living be trust property, can the Billing Authority claim your "living" is property that they have ownership of ?

Body of Persons, Corporate or unincorporated = Now that does sound like trust language to me, you have a Body or Corpus, that is the trust.

Any activity carried on by = the purpose of the trust, albeit very general, the body of the trust must specify the parties thereto.

The secretary of State (the Estate) gets to amend or define the law of the trust which is expressly revocable so he must be the settlor, that just leaves the beneficiaries and the trustees and possibly the administrators or executors.

Candor- news worthy

- Posts : 147

Join date : 2017-07-20

Re: Liability Order in Respect of Council Tax....

Re: Liability Order in Respect of Council Tax....

So after all the tooing and throwing over whether were a man a person a beneficiary a trustee or whatever else we can be, what help can be offered to the op about his/her liability order.

Jinxer- Very helpful

- Posts : 436

Join date : 2017-06-03

Re: Liability Order in Respect of Council Tax....

Re: Liability Order in Respect of Council Tax....

I think given the circumstances and our need for developing and testing these theories it would be in the best interests of the OP to do what Daveron said and pay it if possible or come up with some sort of payment plan. People are getting into quite a bit of trouble for fighting this stuff without the relevant knowledge to back it up. Pay if you can, pick your battles wisely to live to fight another day!

Waffle- dedicated

- Posts : 786

Join date : 2017-03-27

Page 2 of 7 •  1, 2, 3, 4, 5, 6, 7

1, 2, 3, 4, 5, 6, 7

Similar topics

Similar topics» A signed statement that no insurance claim has or will be made in respect of this account.

» Peace Keepers

» Council Tax Liability Order

» Liability Order - Bailiff called - CMS/CSA

» Rossendales in respect of Council Tax debt...

» Peace Keepers

» Council Tax Liability Order

» Liability Order - Bailiff called - CMS/CSA

» Rossendales in respect of Council Tax debt...

Page 2 of 7

Permissions in this forum:

You cannot reply to topics in this forum|

|

|